BACKGROUND

To fully understand this case, it’s important to know that RaboDirect Ireland has a different remit to any other bank in this market. While RaboBank abroad offers a full range of financial services (current accounts, savings, loans etc.), here in Ireland RaboDirect provides safe and secure savings and investments services only. Success means having more funds on deposit.

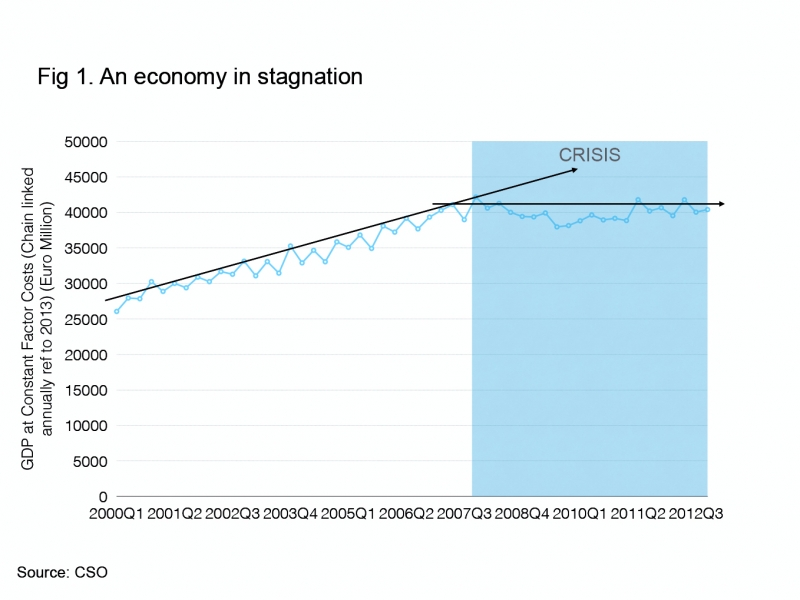

It is not possible to write any paper on banking without referencing the savage demise of the Celtic Tiger, bludgeoned to death by builders, bankers, excessive spending and global recession in 2008, leaving in its wake all sorts of casualties and a financially nervous public.

And with our failing economy, our appetite for savings fell (fig 3).

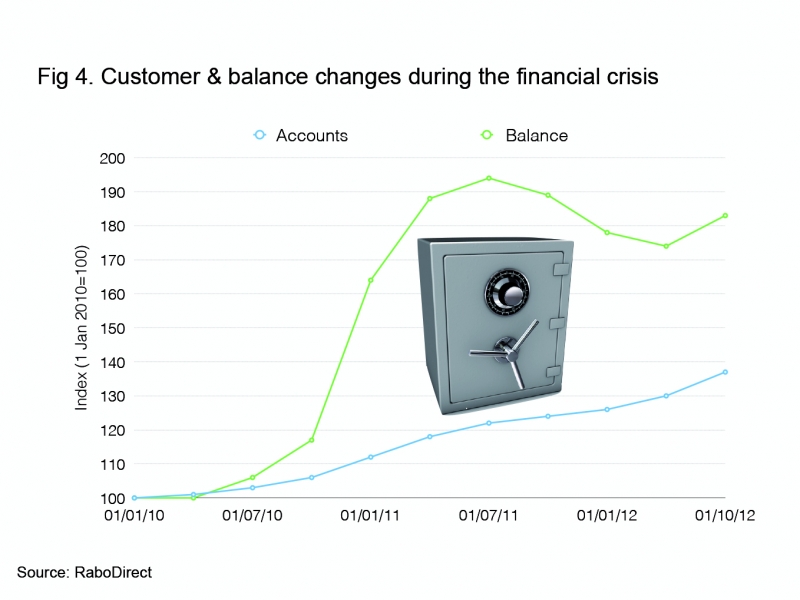

Ironically, this created an opportunity for RaboDirect. In contrast to the falling credit rating of Ireland and her domestic banks, RaboBank was one of the most secure banks in the world, and could claim such. And with fears of bank failures, currency collapses and all manner of financial Armageddons, customers and money flooded into RaboDirect at this time, as savers moved their deposits to safer havens.

RaboDirect Ireland was fulfilling its remit to boost their deposit book.

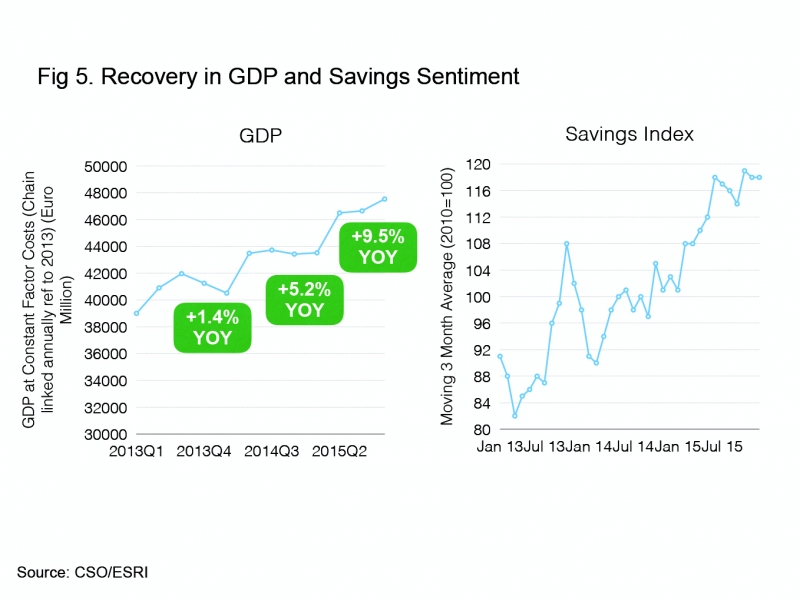

And then came the recovery, and with it more money and interest in savings.

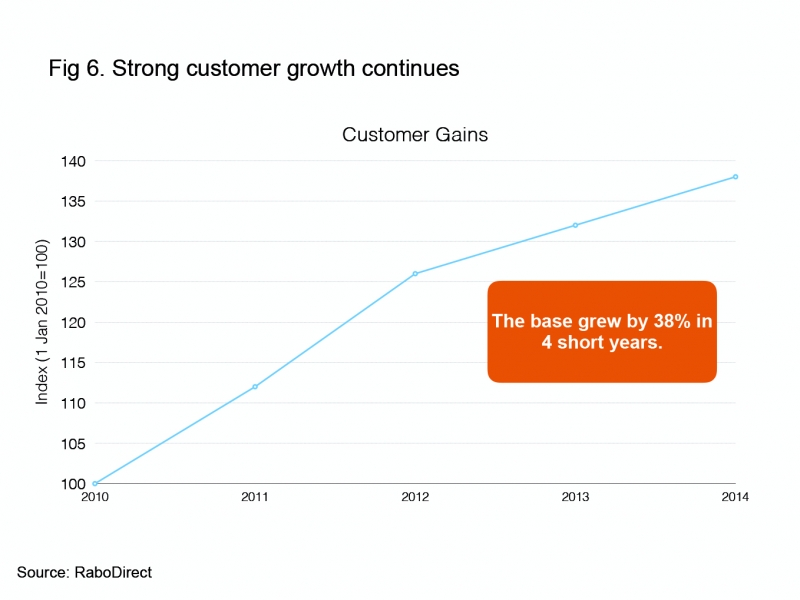

And RaboDirect continued on from its early success, growing customers numbers year on year, increasing the base by 38% from Jan 1, 2010 to Jan 1, 2014 (fig 6).

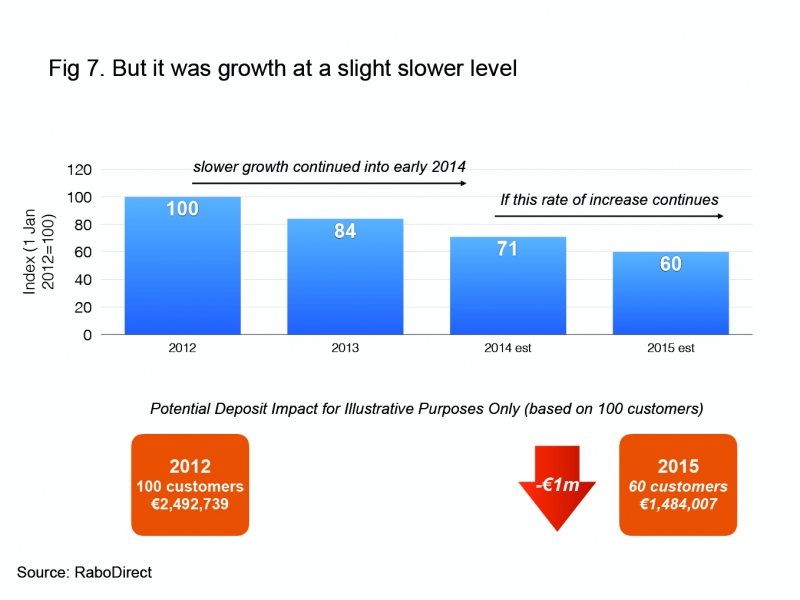

But this growth was starting to come at a slightly lower rate than previously; something RaboDirect wanted to tackle and reverse in order to optimise their deposit growth.

READ THE FULL CASE STUDY BELOW