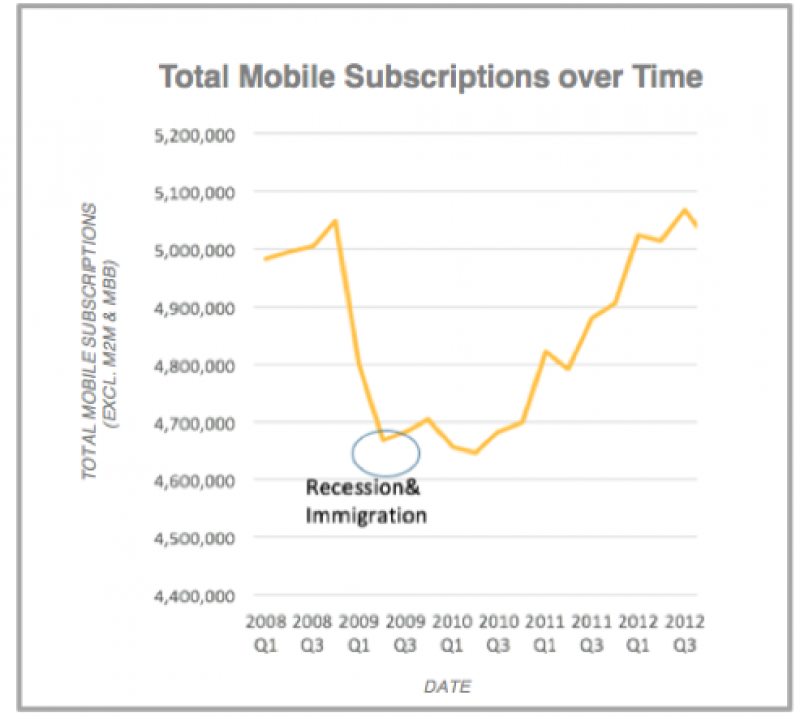

MARKET OUTLINE – IRISH MOBILE MARKET REACHES ITS PEAK

- By the end of 2012, the Irish mobile phone market had peaked – subscriptions exceeded people in the market as penetration reached 119%

1

1

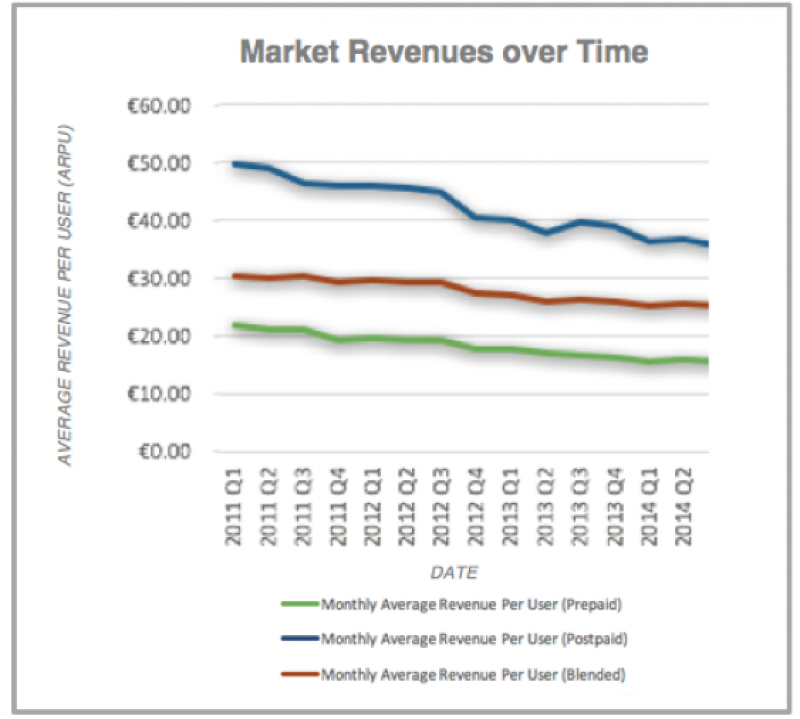

DECLINING REVENUES ACROSS THE MARKET

- Network offers had become richer and deeper as operators aggressively fought for market share. Revenues were driving downwards, which further fueled the competitive roundabout

2

2

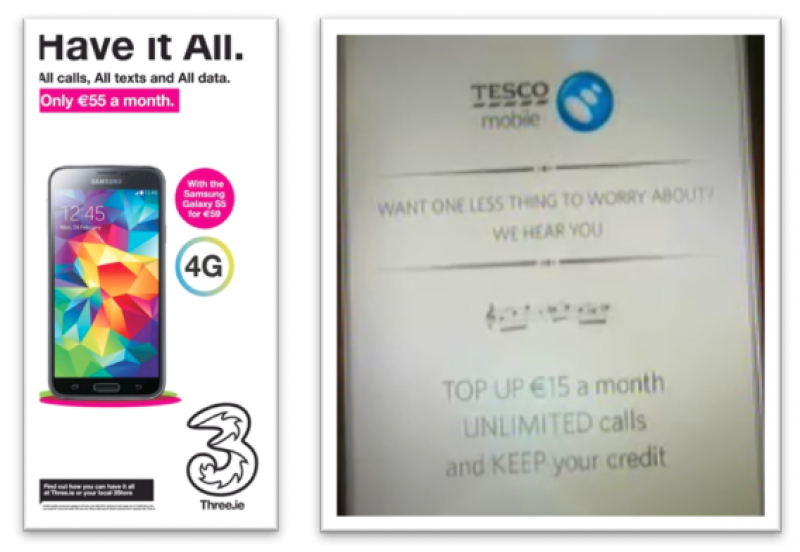

VODAFONE’S NUMBER ONE MARKET POSITIONING WAS AT RISK

- Vodafone were number one in the market, but their market share of subscriptions was dropping thanks to highly aggressive new entrants, who were effectively buying share.

- Tesco was offering cheap offers on the Pre-Pay side, and Three Mobile were going after the Bill Pay market with their “All-you-can-eat” data offer.

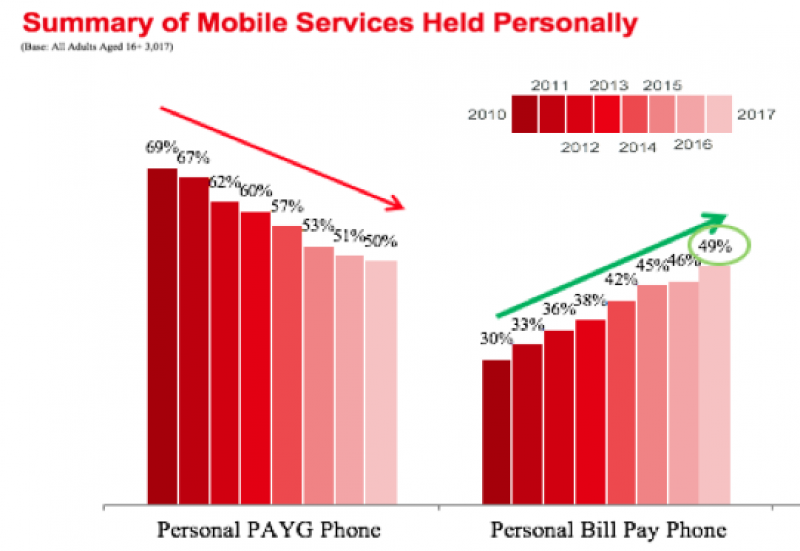

AS THE MARKET STAGNATED, PRE-PAY WAS IN DECLINE VS THE GROWING BILL PAY SEGMENT

- The main growth in the market was in conversion from Pre-Pay to Bill Pay contracts.

3

3

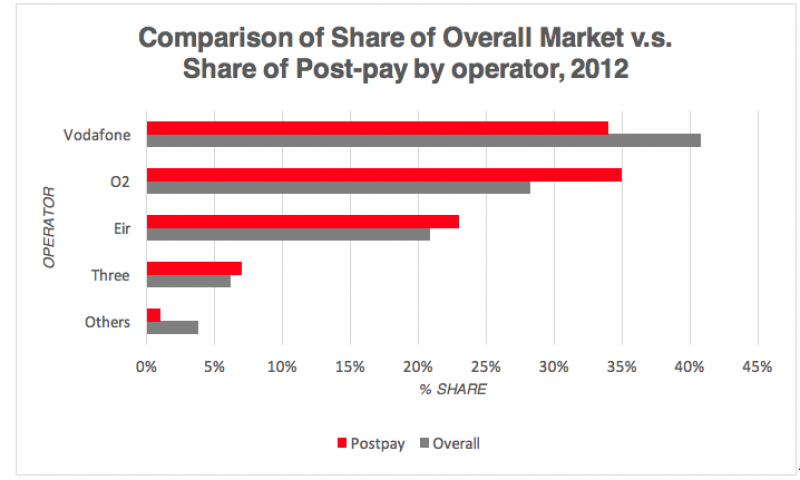

However, despite its overall market leader position, Vodafone were not No. 1 in the more dynamic and profitable Bill Pay market.

4

4

WITH A COMPETITOR MERGER AFOOT, VODAFONE HAD A BATTLE ON ITS HANDS – THE FIGHT TO MAINTAN FIRST PLACE

- In July 2014, just one year into Vodafone’s new strategy, everything was set to change for the Irish telecoms market. Three Mobile were to purchase O2 Ireland in a deal worth €780m, acquiring approximately 1.5m active customers overnight and growing their market share from 9% to 34%.

- This posed a serious threat to Vodafone’s leadership. Market growth was being driven by Bill Pay where O2 were the incumbent leader5. Coupled with Three Mobile’s rapidly growing market share and deep discounts – the cheapest offers within Bill Pay – and you have a marriage made in telco heaven.

- Vodafone faced a hellishly real danger of slipping behind post-merger.

1. ComReg Quarterly Key Data Reports, 2008-2012

2. ComReg Quarterly Key Data Reports, 2011-2014

3. Vodafone Market Sizing research, Empathy, 2017

4. ComReg Quarterly Key Data Report Q4 2012

5. Vodafone’s base was 36% Bill Pay; O2’s base was 38% Bill Pay; Three’s base was 11% Bill Pay.